Write your own queries and screen stocks like a pro.

Our investment philosophy defines the strategic approach we take to identify opportunities, manage risks, and achieve sustainable returns. It guides our decision-making and shapes our path to long-term financial growth.

Double Digit Earnings Growth: Investing in companies with strong financial performance to generate favourable returns.

Market Leadership: Focusing on companies with high-margin products and a substantial market share to ensure long-term profitability.

Start Screener

Market Dominance: Targeting companies with strong control over pricing and distribution to achieve sustainable growth.

Looking for Sudden Opportunities: Seeking companies poised to benefit from favourable government policies.

Start Screener

High Quality at a Low Price: Looking for undervalued or fairly valued companies with strong fundamentals that have the potential for attractive returns.

Safety Margin: Prioritising investments offered at a significant discount to their intrinsic value to reduce risk and enhance potential returns.

Start Screener

Growth and Value Investment: Combining growth and value strategies to achieve a balanced portfolio with long-term growth and attractive valuations.

Start Screener

Clean Accounting Practices: Emphasising investments in companies with transparent financial statements to minimise risk factors.

Start Screener

Selective Approach: Carefully evaluating opportunities and selecting high-quality businesses at reasonable prices to ensure long-term success and strong returns.

Tracking Sensibly: Monitoring selected stocks closely through fundamental analysis, technical charts, and staying updated with relevant company news.

Start Screener

A stock screener is a technical tool programmed to filter out or screen the stocks from a pool of listed companies in the stock market. Investors or traders input their requirements in predetermined, easy-coded terms into the tool. Then the software runs the code and finds out the best list of companies that match the given criteria.

Such screening tools are useful in various ways. Both traders and investors can help and reduce their manual work by using a good screener based on their criteria. Most of the best stock research and analysis tools in India offer different segment-based stock filtration services (i.e., stocks for Momentum trading, intraday, Long-term Value investing, etc.).

With that, many Indian platforms also offer localized features, sector-based filters, and live market data or reports.

The question is quite objective and depends on your goal and style. Many investors and traders like to focus only on a certain set of stocks or securities. For them, using a screener might not be the best option, but for those who want to navigate the market with precision and utilize their time effectively, using a screener is an absolute must.

Whether you're a day trader looking for stocks with breakout opportunities, a swing trader seeking momentum setups, or even a long-term investor trying to find undervalued stocks on time, a stock screener is your essential toolkit, helping you filter thousands of stocks based on your strategy, saving hours of manual research.

There are both free and paid stock screening tools available. The free tools offer core functionality but may lack depth. Other hand, paid screeners give access to in-depth research, alerts, and exclusive insights.

While talking about the best stock market analysis tools for the indian market, you should also consider the A to Z stock screening tool that provides both technical and fundamental research and filtration facilities.

Here's the list of key features you should look for in a screening tool:

Again, choosing between a fundamental and a technical screener depends on your investment style and goals. The most successful stock market participants prefer to choose both.

Fundamental screeners help you analyse a company’s intrinsic value through key data like: Revenue growth, Profit margin, Valuation ratios (P/E, P/B), ROE, ROCE, etc.

On the other hand, technical screener filters stocks based on price patterns, volume, and momentum indicators like RSI, MACD, Moving averages (SMA/EMA), Support-Resistance, Volume, etc.

But without getting separate tools for technical and fundamental screening, respectively, go for the stock research and analysis tool, which provides both.

Introducing India’s best stock screening tool in 2025, STOCK FINDER, powered & designed by Insights.Market — The Indian stock analysis and screening portal of SEBI-certified equity research house INVESMATE INSIGHTS [Reg No: INH000017985].

The platform is built by our team of qualified research analysts using cutting-edge technology to ensure premium-quality research and guidance.

The STOCK FINDER is the all-in-one stock screening and research tool where you can filter out and analyze as well as make your own strategies with all the stocks, from multibagger to penny, for intraday purposes, swing trading, and long-term.

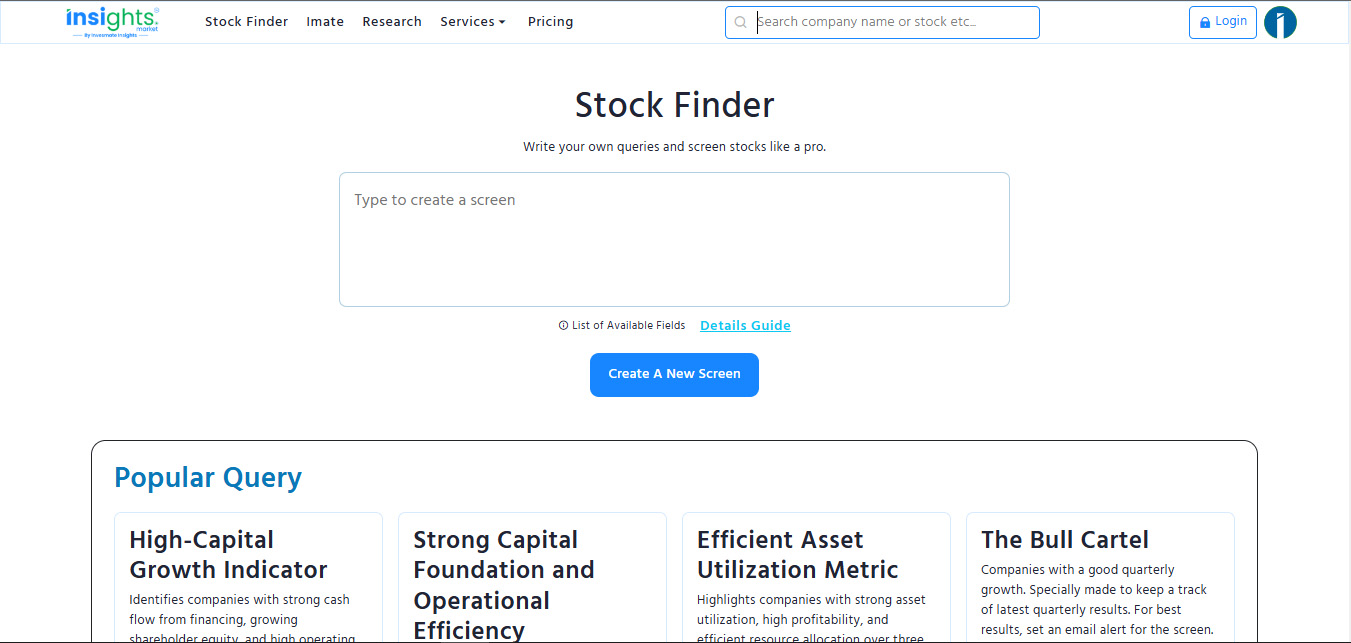

The interactive interface makes Insights.Market easy to access for all. To use Insights.Market's STOCK FINDER tool: click on this link.

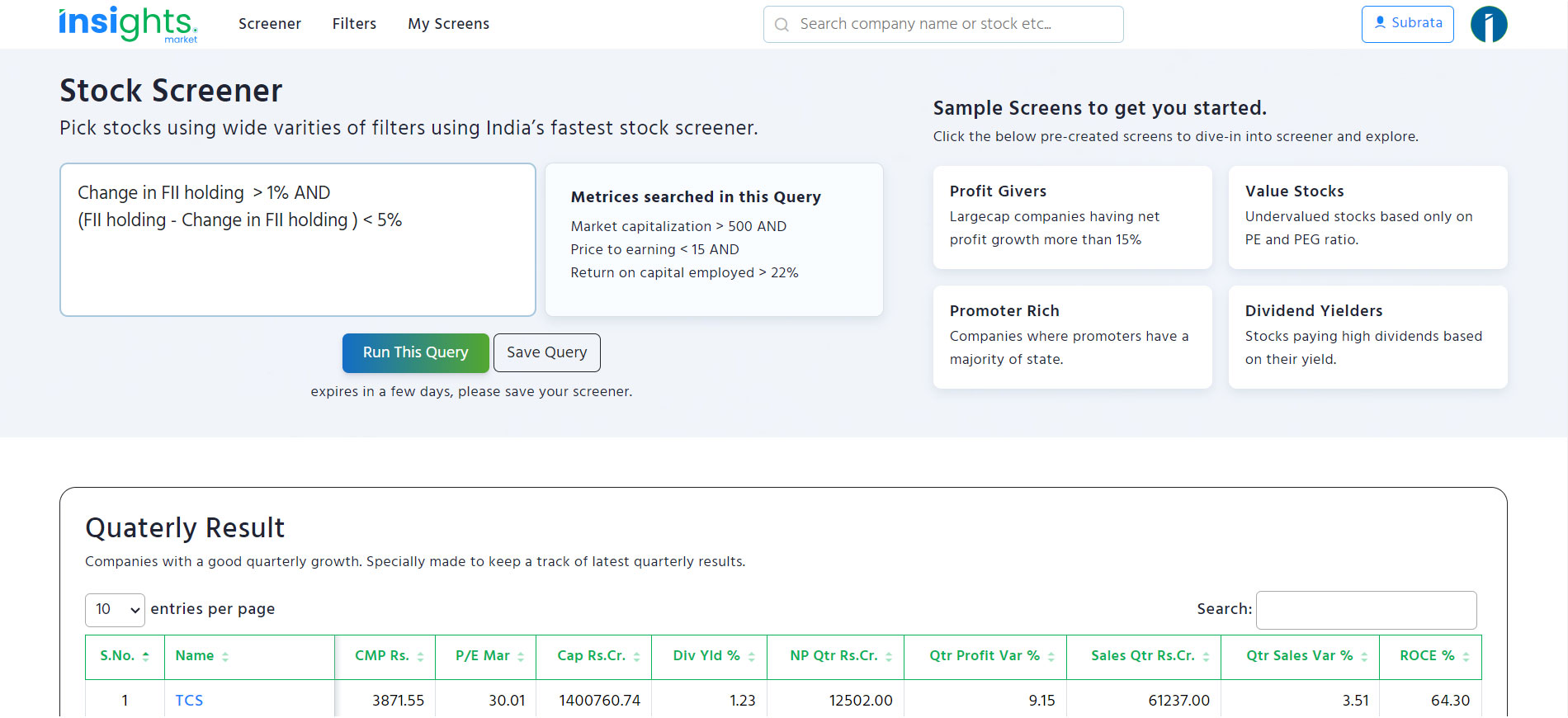

You will get a box with the “Create a New Screen” option.

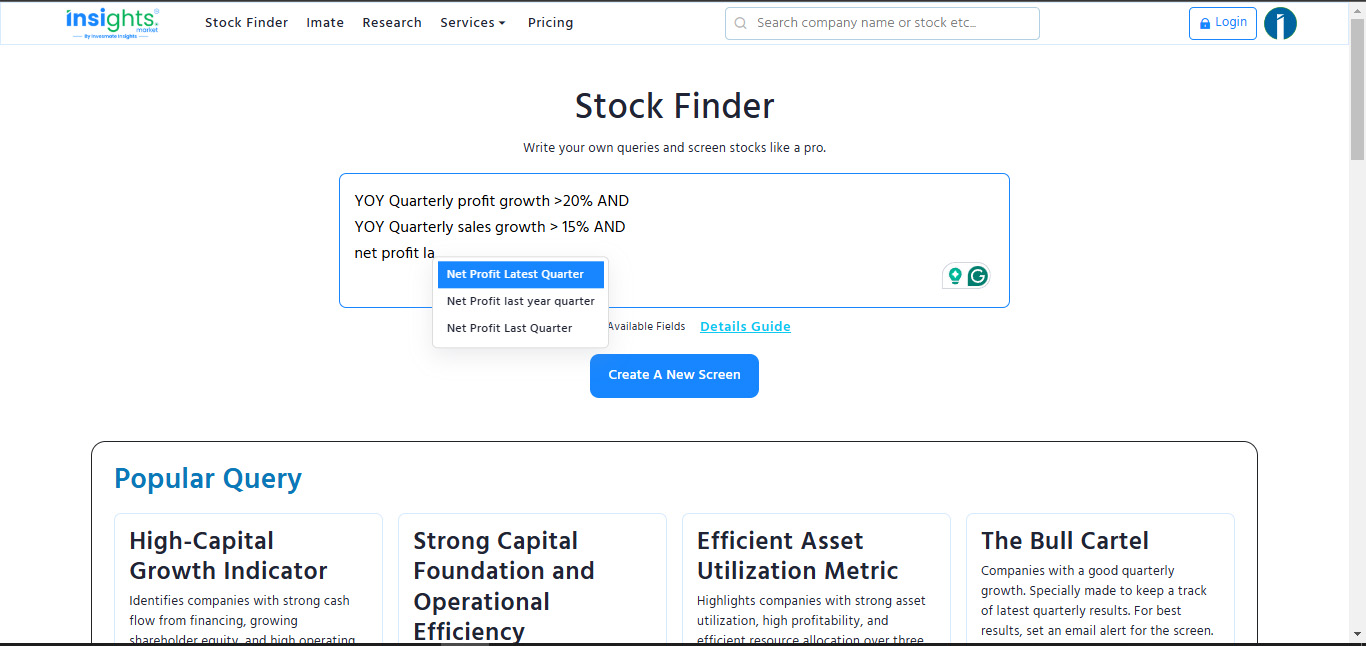

Step 1: Write Your Screening Criteria in the box

Choose your criteria from the dropdown filters. Must use logical operators (AND, OR) wisely.

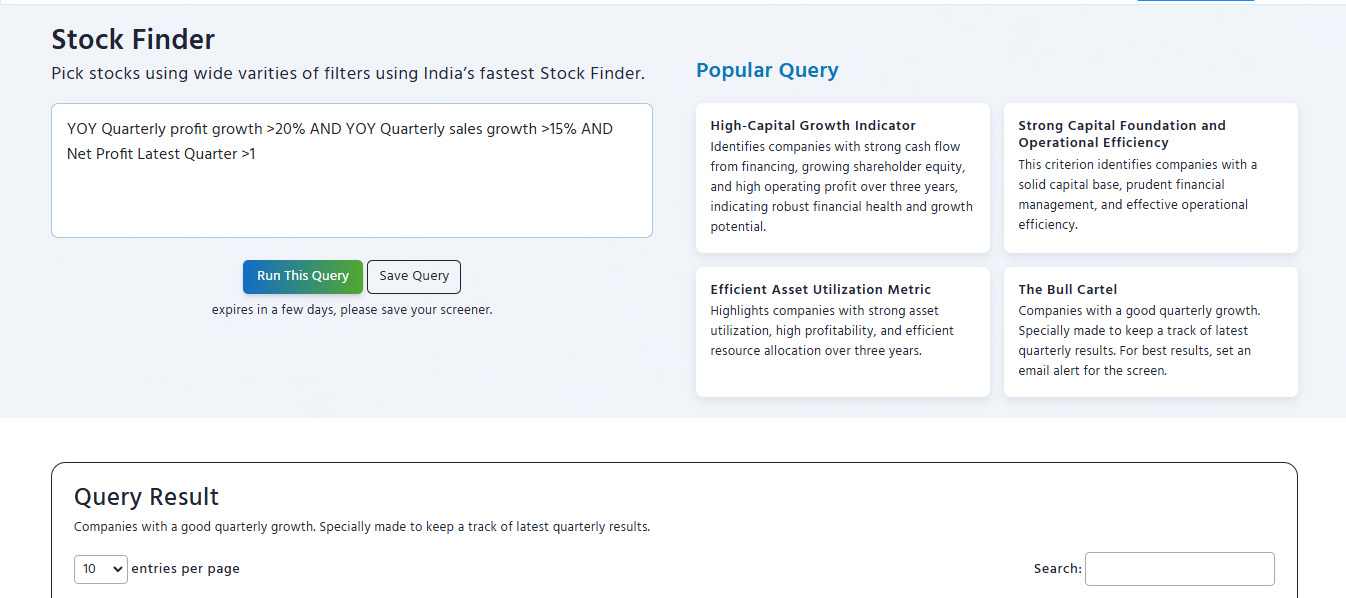

Step 2: Click on the "Run this query" button.

Step 2.1: You can get the syntax error message. In that case, review your criteria with the proper operator (AND, OR)

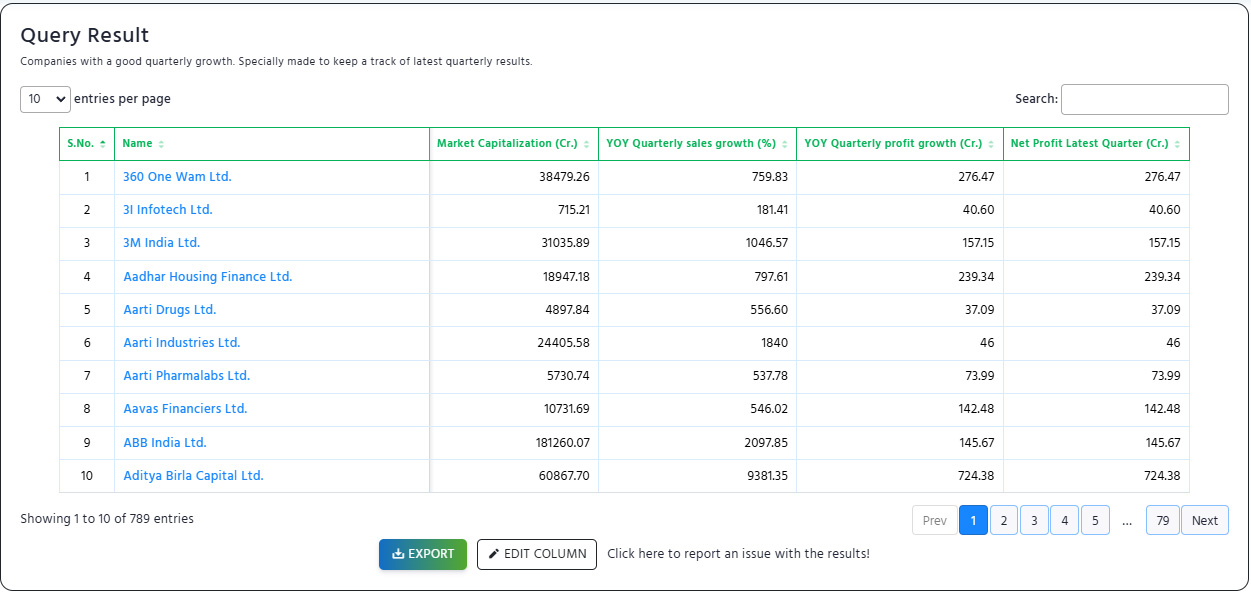

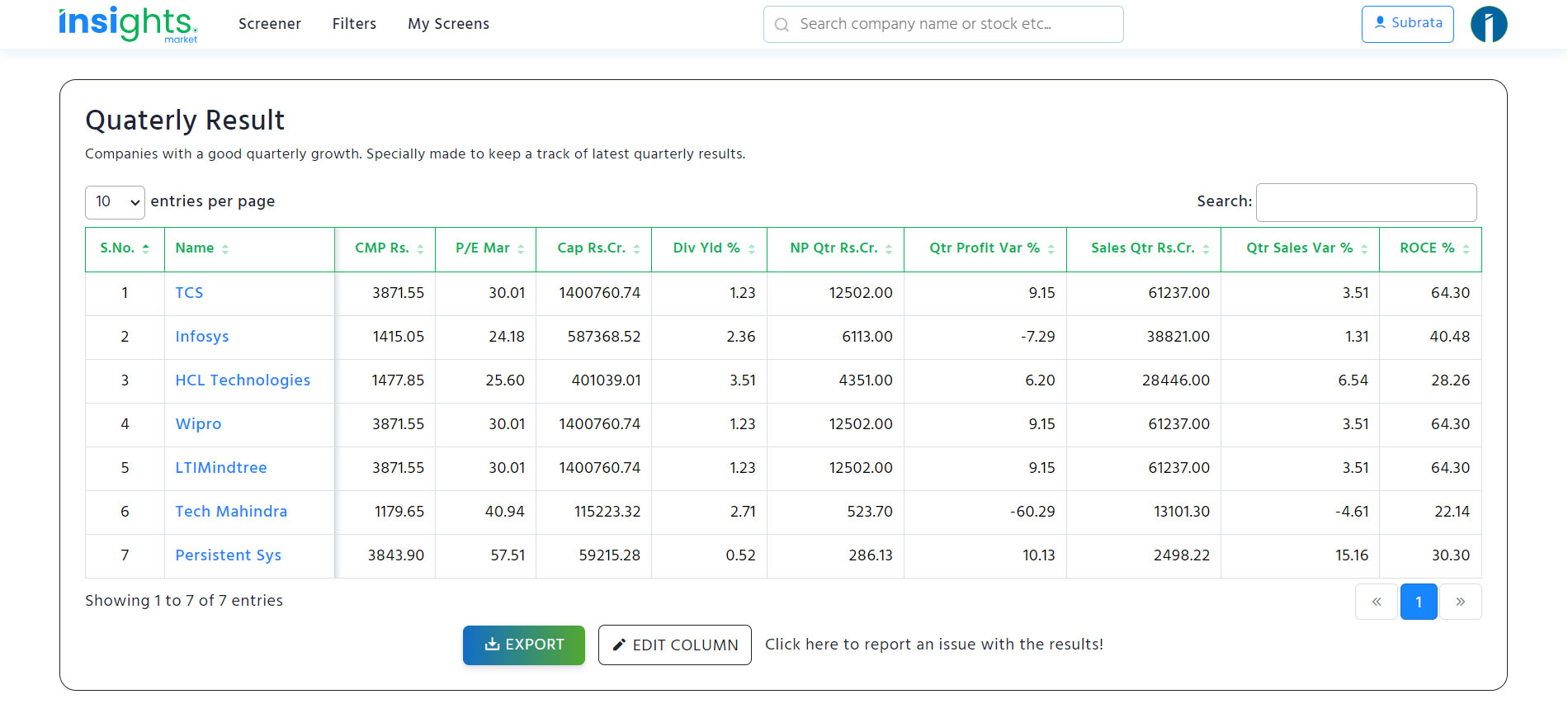

Step 2.2: If your code runs successfully, you’ll get a list of stocks that match your conditions.

Step 3: Analyze & Backtest

You can see the list of stocks from the below table. Upon clicking on the respective stocks, you will be redirected to a separate page from where you can start research from the overview to charts to peer comparison—everything at a single click.

Points to remember:

1. Filter by sector and market cap first

2. Use valuation ratios to find underpriced gems

3. Add technical indicators to time your entry

4. Last but not least, always validate the provided picks with recent news & performance trends [Must].

There are multiple stock screening tools available. Choose what suits your objective. For all-in-one help, register for Insights.Market

Yes, tools like INSIGHTS. MARKET: Stock Finder is great for real-time intraday setups, from analyzing to informed decision-making.

Most reputed and paid screeners are accurate with NSE/BSE data, but always cross-check before taking any conclusion.

It depends on your strategy, but look for the company with high ROE, consistent profit growth, low debt, and strong cash flow.

Generally, paid tools are much more efficient than free ones. But if you're skeptical about investing in paid tools, we would say go for the trial offer.

Check if the tool fits your requirement, and then you can go purchase that. To avail of Insights.Market's trial access, click on this link.